In this article you will learn about how to become a rich man of Pakistan.Pakistan’s tech sector is, and the e-commerce market expects a 12.5% yearly growth. These numbers show wealth creation opportunities in Pakistan’s evolving economy. Understanding what investing is and its meaning is crucial for those looking to capitalize on these trends. growing at an impressive 20% annually

Becoming wealthy in Pakistan requires more than just watching market trends. Pakistani tech professionals earn 70% less than their US counterparts, yet remote workers in the same field can. The digital world offers endless possibilities, with over 160 million internet users, 85% of whom shop online. Earn between $204,000 and $328,000 annually.

Many paths lead to wealth creation in Pakistan. Real estate investments yield 600/sq—ft in rental income. Fixed deposits offer up to 8% annual returns. Building an online business can be profitable, too. This piece explores proven wealth-creation strategies that help build lasting wealth in Pakistan’s changing economy.

Table of Contents

ToggleUnderstanding Wealth-Building Fundamentals in Pakistan:

Pakistan’s unique financial landscape shapes how people build lasting wealth here. The leads the financial system covering commercial banks, development financial institutions, investment banks, and non-bank financial entities. Understanding how to invest money and the types of investments available is crucial for success in this environment, State Bank of Pakistan.

Key Principles of Building Sustainable Wealth:

Three main pillars support wealth accumulation in Pakistan. Financial institutions must incorporate environmental factors into their decisions. The shift from traditional to green industries opens up huge opportunities to build wealth. It also brings new ways to grow money, which are becoming popular alternative investments, such as green bonds and sustainable investment funds.

Common Myths About Getting Rich in Pakistan:

Many myths hold back wealth creation in Pakistan. People wrongly believe that the country can’t survive without foreign aid. Pakistan’s economic problems stem from using too much foreign currency rather than lacking resources. There’s another reason why wealth building gets complicated—many think businesses need subsidies and special treatment to succeed. In stark contrast, businesses should thrive through fair competition and smart practices.

Setting Realistic Financial Goals and Timelines:

To set financial goals in Pakistan, you need a well-laid-out approach. Start by creating clear goals that match your situation. Experts say you’re more likely to succeed when you know exactly what you want. Understanding your investment horizon becomes crucial.

Your goals should fit into three timeframes:

- Short-term goals (under one year): Build emergency funds and handle immediate needs

- Mid-term goals (1-5 years): Buy property and grow your business

- Long-term goals (over five years): Plan retirement and protect your wealth

Financial plans need regular updates as your life circumstances and economic conditions change. The State Bank of Pakistan helps create new opportunities through green financing and sustainable development. These programs match global trends and give you more ways to build lasting wealth in Pakistan’s changing economy.

Traditional Wealth Building Methods:

Pakistan’s traditional wealth-building strategies revolve around three proven approaches that still yield substantial returns to investors. These methods form the backbone of the country’s financial investment strategies.

Real Estate Investment Strategies in Pakistan:

Real estate remains the lifeblood of wealth creation in Pakistan. Urban residential properties bring the most critical returns through rental income and value appreciation. Commercial real estate properties in high-traffic areas generate steady rental income. Industrial real estate properties like warehouses and factories create lucrative opportunities, especially in manufacturing hubs like Faisalabad and Sialkot.

A successful real estate investment requires a full picture, including verification of property ownership and compliance with local regulations. Maintenance and effective tenant management are crucial for preserving the property’s value and consistent returns.

Stock Market and Mutual Fund Opportunities:

Pakistan’s stock market is a vital platform that creates wealth through capital formation and investment. Mutual funds are available as an entry point for investors. These professionally managed funds give investors several advantages: minimum investments starting from PKR 50,000.

- Daily subscription and redemption flexibility

- Tax benefits under the Income Tax Ordinance

- Portfolio diversification in assets of all types

- Professional fund management expertise

Individual investors show increased participation in the market. Investment options range from equity funds seeking maximum returns to income funds that generate competitive yields through government bonds and other instruments. ETFs (Exchange-Traded Funds) are also gaining popularity as a way to diversify investment portfolios.

Business Ownership and Entrepreneurship:

Business ownership paves a powerful path to wealth creation in Pakistan. The country’s growing industrial base and expanding middle class create numerous entrepreneurial opportunities. It is projected to add 2.1 million households by 2025.

The government supports entrepreneurs through structured initiatives that include:

- Three-year tax relief programs

- Regulations Supporting Local Venture Capital Firms

- Infrastructure development for startups

Some industries show exceptional promise to aspiring entrepreneurs. The information technology, business process outsourcing, retail, hospitality, tourism, and manufacturing sectors offer substantial growth potential. Resources and an existing knowledge base determine the choice between these sectors.

In this welcoming landscape, women now represent 43% of global entrepreneurs. The private sector’s role through incubators and venture capital support remains strong, though funding challenges persist compared to regional counterparts.

Smart Investment Strategies for Pakistan’s Economy:

Success in Pakistan’s investment market requires a strategic approach, solid market knowledge, and careful planning. The Board of Investment (BOI) helps investors through several initiatives that focus on special economic zones and regulatory modernization. Understanding where to invest money and the best options is crucial for success in this dynamic environment.

Analyzing Investment Options in Pakistan:

Pakistan offers investment opportunities across sectors. The government wants to from its current 15% level. The Pakistan Stock Exchange (PSX) serves as the main platform for investors and has delivered compounded annual returns of 11.92% over eleven years from 2011 to 2022, increasing investment to 20% of GDP.

New investors should know that Pakistan’s investment world offers several options. Fixed deposits give predetermined interest rates and work well for conservative investors who want stability. Government-backed returns through National Savings Schemes attract risk-averse investors. The stock market and certain mutual funds can offer attractive returns for those seeking high-yield investments.

Risk Management and Portfolio Diversification:

Risk management plays a vital role in creating lasting wealth. The State Bank of Pakistan recognizes several financial risks, including market, credit, and liquidity. Research shows that a diverse portfolio of 10 stocks can minimize risk effectively in the Pakistani market. This underscores the importance of maintaining a diversified investment portfolio.

Investors should think over these factors to manage risks:

- Market risk assessment through regular portfolio monitoring

- Credit risk evaluation, which makes up over 50% of global financial market risks

- Liquidity risk management to avoid potential business failures

- Operational risk mitigation through systematic approaches

Long-term vs. Short-term Investment Planning:

Your investment timeline greatly affects strategy selection and potential returns. Long-term investments in Pakistan’s market historically perform better than short-term trades. The KSE-100 Index performance confirms this approach with consistent returns over extended periods. This aligns with the principle of compound interest, where earnings generate additional earnings over time.

Short-term investments provide better liquidity but usually generate lower returns than long-term options. A balanced approach that combines both timelines tends to work best. Smart investors arrange their investment timeline with specific financial goals, such as funding children’s education or planning for retirement.

Tourism and related sectors are particularly attractive for long-term investors under the current investment policy framework. The engineering, textile, automotive, and pharmaceutical industries also present promising opportunities under the new tariff realization initiative.

Building Multiple Income Streams:

Broadening income streams is the foundation of wealth building in Pakistan’s ever-changing economy. Research shows that people who spread their income sources get better risk-adjusted returns on their assets and equity. This approach aligns with modern investment ideas and caters to different types of investors.

Passive Income Sources for Pakistanis:

Pakistani citizens have several proven ways to generate passive income. Property investments through rental income remain stable, and modern apartments and commercial spaces give consistent returns. We focused on intellectual property royalties as another option that lets creators earn regular payments when others use their work. Equity investments through mutual funds can bring monthly returns between PKR 50,000 and PKR 100,000, depending on market conditions. Dividends from stocks can also provide a steady stream of passive income.

Active Income Optimization Techniques:

The market needs strategic approaches to optimizing active income. Pakistan’s e-commerce sector shows great promise, with a projected annual growth of 12.5%. Freelancers now earn PKR 20,000 to PKR 200,000 monthly, and YouTube content creators make between PKR 30,000 and PKR 500,000 each month.

Key active income streams include:

- Digital product creation and online course development

- Social media management and content creation

- Virtual assistance and professional services

- Online tutoring and skill-based consulting

Balancing Different Revenue Channels:

Risk factors need careful thought when managing revenue channels. Research proves that families with multiple earning members are more successful at spreading their income sources. Education plays a vital role and positively affects various income streams.

Banks have shown that non-interest-based activities boost overall financial performance. Geographic expansion might become more important soon, though current data shows it has a limited effect on risk-adjusted returns.

Macroeconomic factors need attention to achieve optimal balance. Interest rates help risk-adjusted returns, but GDP and inflation rates can hurt financial performance. A mix of traditional and innovative income streams will help create lasting wealth.

The priority should be to develop multiple revenue sources while managing risks. This strategy protects against external shocks and helps maintain steady household income. Building wealth in Pakistan depends on combining different income streams with continuous learning and adapting to market changes.

Financial Education and Wealth Management:

Money management knowledge lays the foundation for building wealth in Pakistan. Only 26% of adults understand simple financial concepts. The State Bank of Pakistan runs structured programs to boost economic stability through financial education. This education is crucial for effective retirement investment planning and overall financial security.

Essential Financial Literacy Skills:

To become skilled at managing money, you need to understand seven key concepts. Budgeting skills help you track what comes in and goes out. Knowledge about saving and investing builds wealth over time. Smart credit management leads to responsible borrowing. Financial planning creates strategies for the future. Risk management protects what you own when investing. Understanding financial products leads to better choices. Economic awareness helps you adapt to market volatility.

The Institute of Financial Markets of Pakistan (IFMP) works to increase people’s use of capital market products. The organization has joined professional groups to boost investor awareness among students and small businesses.

Money Management and Budgeting Strategies:

A good budget needs specific amounts set aside for regular expenses. Your budget should put 60% toward fixed living costs and 40% toward savings and optional purchases. Success in budgeting depends on the following:

- Tracking and recording all expenses

- Creating an emergency fund

- Setting money aside for medical costs

- Planning for yearly bills and insurance

Women who head households manage money better than their male counterparts. Their decision-making shows this clearly – they’re twice as likely to keep children in school and protect valuable assets during tough times.

Working with Financial Advisers:

Financial advisers play a vital role in creating wealth. These experts know finance well and can maximize your returns through smart decisions. They offer several key services:

- Creating complete financial plans

- Building wealth through better saving habits

- Watching over long-term savings plans

- Making sure investments are diverse

- Choosing tax-smart investments

- Getting ready for surprises

IFMP’s Financial Advisors Certification Program ensures advisors understand financial planning, investment management, insurance planning, and retirement planning. This certification covers financial planning ideas, retirement strategies, and tax issues unique to Pakistan’s market.

Working with certified financial advisers benefits anyone looking to build wealth. These professionals understand local markets and give unbiased financial advice. They help prevent emotional investment choices, especially when markets get rocky, which systematically protects and grows your money.

Success Stories of Pakistan’s Richest Men:

Pakistani entrepreneurs’ success stories show how determination and strategic vision create extraordinary wealth. These business leaders’ experiences are a great way for aspiring entrepreneurs to gain insights and understand effective wealth creation strategies.

Case Studies of Top Pakistani Entrepreneurs:

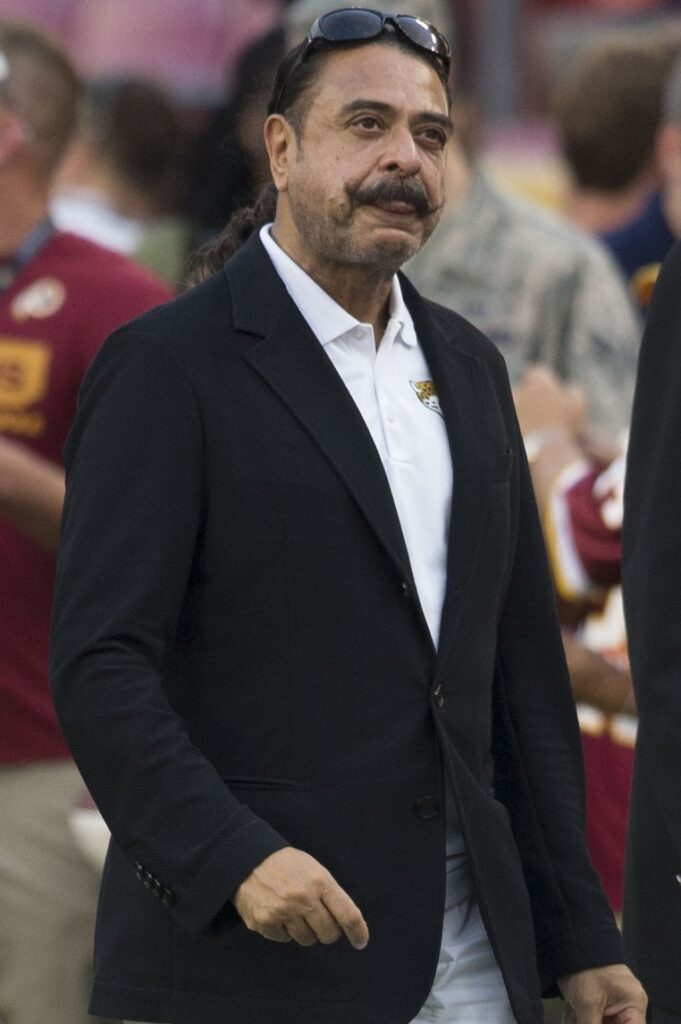

Shahid Khan’s story stands out as the ultimate rags-to-riches tale. At age 16, he arrived with just USD 500 and worked as a dishwasher while studying engineering. His current net worth reaches USD 13.30 billion, making him the wealthiest person of Pakistani origin. His company, Flex-N-Gate, grew from USD 17 million in sales to USD 8.89 billion in 2020.

Khan’s business skills go beyond manufacturing. He owns the Jacksonville Jaguars NFL team and Fulham F.C. of the Premier League. His success in sports management led him and his son to co-own All Elite Wrestling (AEW).

People often call Mian Mohammad Mansha Pakistan’s Mukesh Ambani. He turned Nishat Textiles Mills into a diverse conglomerate. His estimated net worth stands at USD 5 billion. His success comes from smart expansion into banking, real estate, cement manufacturing, and power generation.

Key Lessons from Pakistan’s Business Leaders:

These entrepreneurs teach us vital lessons. Mudassir, who co-founded Careem, shows how to create multiplier effects. After Uber bought Careem for over USD 3 billion, his team invested in 91 companies and guided founders at 32 startups. Former Careem employees launched 124 new businesses across South Asia.

Successful Pakistani business leaders always stress:

- Building reputation and thinking long-term instead of chasing quick profits

- Creating sound HR policies that build lasting institutions

- Staying calm during business challenges

- Finding creative solutions in Pakistan’s unique business environment

- how to make money from facebook

Common Traits of Successful Pakistani Businessmen:

Patterns emerge when studying Pakistan’s wealthy entrepreneurs. Their success often comes from finding untapped market opportunities. For example, Sir Anwar Pervez started the trend of late-night store hours before growing Bestway Group into the UK’s 10th-largest private business.

These business leaders share several traits:

- Strategic Vision: They know how to spot trends and find new opportunities

- Resilience: They stay composed while handling obstacles

- Adaptability: They see change as a chance to grow

- Innovation Focus: They look for new ways to solve market challenges

Successful Pakistani entrepreneurs prioritize giving back to society. Forbes magazine featured Shahid Khan’s story on its cover as a symbol of the American Dream. Mansha’s charitable work shows his steadfast dedication to social development.

These leaders stress the need to learn and adapt constantly. Their success stories verify the entrepreneurial ecosystem and attract more early-stage funding and investor interest to Pakistan. Of course, their achievements prove that determination, strategic thinking, and proper execution can create substantial wealth in Pakistan’s ever-changing business environment.

Conclusion:

Creating lasting wealth in Pakistan works best when you blend time-tested methods with new opportunities. Many successful Pakistani entrepreneurs have shown that wealth grows from solid financial knowledge, multiple income sources, and wise investment decisions.

To build wealth, you just need to look at different investment options, which range from real estate and stocks to new digital ventures. Smart business leaders know this well and keep learning to stay ahead.

Pakistani success stories share some common threads. These wealth creators have a clear vision, bounce back from setbacks, and adapt quickly to change. Their journeys prove you can still build wealth with determination and the right business moves.

Pakistan’s ever-changing economy opens up opportunities in many sectors. You can create lasting financial success by managing risks, spreading investments, and taking a balanced approach. The real power comes from mixing traditional wealth-building methods with digital opportunities. This creates a strong base for lasting wealth in Pakistan’s shifting economic world.

FAQs of how to become a rich man of Pakistan:

Q1. What are some effective ways to build wealth in Pakistan?

Some effective ways to build wealth in Pakistan include investing in real estate, participating in the stock market, starting a business, creating multiple income streams, and focusing on financial education. Diversifying investments, managing risks, and staying informed about economic trends are important.

Q2. How can I increase my financial literacy in Pakistan?

You can increase your financial literacy by understanding key concepts like budgeting, saving, investing, and risk management. The State Bank of Pakistan offers financial education programs, and you can also seek guidance from certified financial advisers. Continuous learning about financial products and economic trends is crucial.

Q3. What are some promising investment opportunities in Pakistan for 2025?

Promising investment opportunities in Pakistan for 2025 include the tech sector, which is growing at 20% annually, e-commerce with a projected 12.5% yearly growth, and green industries. Other sectors like tourism, engineering, textile, automotive, and pharmaceuticals also present the potential for good returns.

Q4. How can I create multiple income streams in Pakistan?

You can create multiple income streams by combining active and passive income sources. Active income can come from freelancing, e-commerce, or content creation. Passive income investments can be generated through rental properties, dividend-paying stocks, or royalties from intellectual property. Diversifying income sources helps manage risk and increase overall earnings.

Q5. What traits do successful Pakistani entrepreneurs share?

Successful Pakistani entrepreneurs often share traits such as strategic vision, resilience, adaptability, and a focus on innovation. They tend to identify untapped market opportunities, think long-term, prioritize problem-solving, and maintain composure during challenges. Many also emphasize the importance of giving back to society and continuous learning.